As a black swan, the COVID-19 pandemic has forced societies worldwide to revise assumptions and come up with strategies for new-normal scenarios. Accelerating remote work and study are upending labor relations and higher education, for instance. In finance, the prospect of prolonged low interest rates and high stock-market volatility is leading money managers to venture outside traditional asset markets.

Once deemed the Wild West of finance, alternative investments have matured and doubled their market share over the past 15 years, according to the Chartered Alternative Investment Analyst Association (CAIA). In a recent report titled The Next Decade of Alternative Investments: From Adolescence to Responsible Citizenship, authors Keith Black and Aaron Filbeck walk us through the consolidation of private equity, hedge funds, emerging markets, real assets, and other investment vehicles despite strong public-market performance.

Once deemed the Wild West of finance, alternative investments have matured and doubled their market share over the past 15 years, according to the Chartered Alternative Investment Analyst Association (CAIA). In a recent report titled The Next Decade of Alternative Investments: From Adolescence to Responsible Citizenship, authors Keith Black and Aaron Filbeck walk us through the consolidation of private equity, hedge funds, emerging markets, real assets, and other investment vehicles despite strong public-market performance.

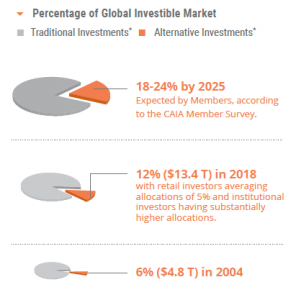

The report also surveyed over 1,000 CAIA members from 45 countries, including senior asset managers, asset owners, bankers, consultants, and intermediaries for their view on the future—and it is promising: from the 6 percent share of the global investment market 15 years ago, alternative assets now account for 12 percent ($13.4 trillion) and could reach almost a full quarter by 2025.

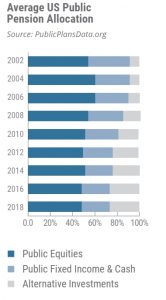

Several factors driving this shift have been underway for years. Startups are staying private for longer, delaying IPOs. New mutual funds and ETFs have granted retail investors exposure to investments usually reserved for high-net-worth individuals. Large institutional investors such as public pensions have been playing catch up with their widening unfunded liabilities, pouring money into alternative assets to try to increase returns.

In 2020, the pandemic has accentuated these and other economic variables, prompting capital flight from traditional assets.

In a push to keep quarantined economies afloat, governments have lowered interest rates to historic lows. “The starting point for a pension plan allocating to government bonds is a money-losing proposition nearly everywhere,” the authors note, citing European treasuries even dipping below zero in nominal rates.

“Up until their peak in mid-February 2020, public equities had outperformed nearly every asset class since the global financial crisis of 2008. . . . The ‘easy money’ is behind us and allocators will need to work harder to meet investor expectations going forward,” they add.

Another development that will give alternative investments a big push is the SEC’s proposed expansion of “accredited investors,” those who are legally allowed to participate in private offerings and hedge funds in the United States.

Woke Capitalism Will Not Go Away

The report includes two interesting case studies: one about the rise and fall of WeWork and the follies of unicorn valuations in venture capital; the other shows why environmental, social, and governance (ESG) factors are here to stay.

The report includes two interesting case studies: one about the rise and fall of WeWork and the follies of unicorn valuations in venture capital; the other shows why environmental, social, and governance (ESG) factors are here to stay.

Cultural and generational change carry the day. As younger investors take up the mantle, ESG considerations will override profitability in many cases. Even then, the report notes that, increasingly, fossil-fuel reliance exposes companies to supply and demand shocks like the ones we have witnessed since early 2020.

Investors in real assets and commodities should likewise take into account non-financial risks such as climate change, environmental regulations, and shifting consumer preferences.

The authors are right to call for a “uniform set of ESG standards, data disclosures, and measurement to serve these rapidly changing client needs.” Investors and managers still lack precise criteria to compare assets beyond feel-good intuition.

For Beta, Not Alpha

Even though the future is bright for the sector, CAIA rightly urges prudence.

Alternative investments, like all financial assets, have their rightful place in a diversified portfolio. They should be allocated to reduce risks from the publicly traded economy and to enhance returns.

“Alternative investments should not be seen as a panacea to dig out of an unfunded liability scenario. This is akin to a desperate casino trip,” the authors warn.

Opening the floodgates of retail investors brings a lot of opportunities but also the potential for abuse and fraud. Stories of retirees losing all their savings in complex instruments they did not fully understand can irreparably tarnish the industry.

This is where education and vigilance step in. The report stresses industry leaders should commit to denouncing lofty promises while broadening understanding, including via the CFA and their own CAIA charter.