On January 18, 2022, Adventus Mining and Salazar Resources secured $235.5 million worth of funding to kickstart the construction of the Curipamba copper mine at the heart of Ecuador. The project managers raised the funds by pre-selling unmined gold and silver to industry leaders Wheaton Precious Metals and Trafigura.

Both companies will disburse the money in ongoing installments during the mine construction. They are also willing to contribute $15 million in capital investment to Adventus Mining.

Financial Overview

- Capital expenditure (estimated): $289.2 million

- Operational expenditure (estimated): $478.1 million

- Capex + Opex: $767.3 million

- Internal Return of Rate: 40.5 percent

- Net Present Value: $373.1 million

- Life of the Mine: 15 years

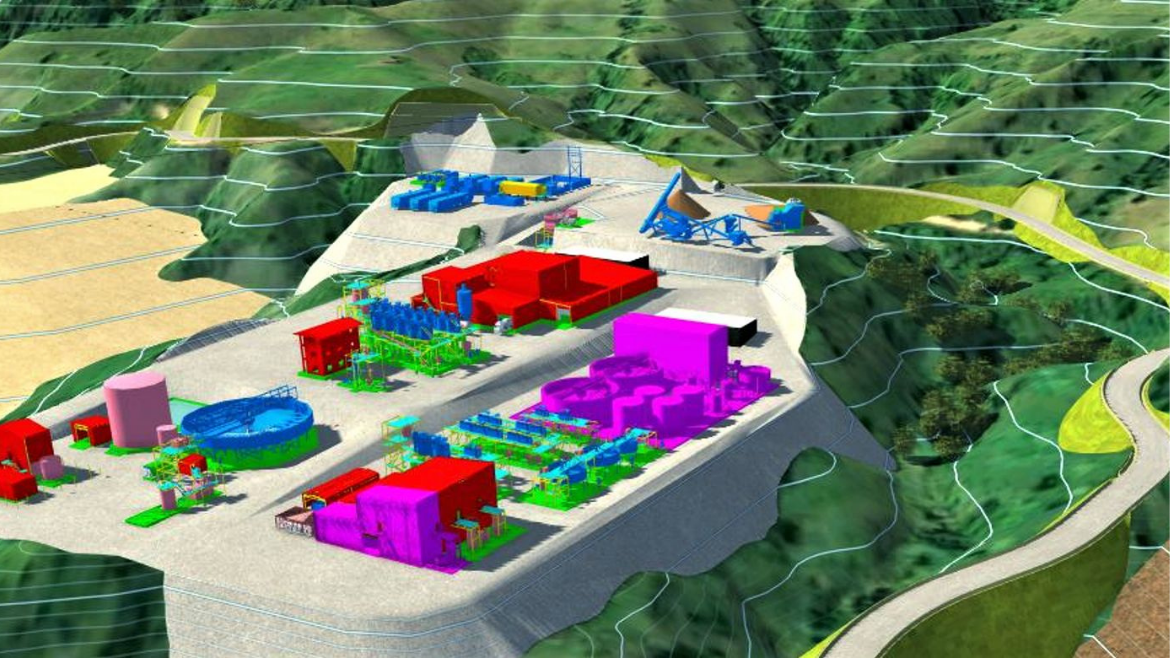

What Does the Curipamba Mining Project Entail?

The Curipamba mining project lies at the center of Ecuador, in the provinces of Bolívar and Los Ríos, a three-hour drive from the main port city of Guayaquil. The project began in 2005 and has created 792 jobs so far.

The field of 21,537 hectares includes plains and hills from 300 to 900 meters above sea level and is home to seven mining concessions. The investment through 2020 in infrastructure and socio-environmental development projects was around $80 million.

These projects include road maintenance and educational-infrastructure improvements, the creation of soccer and dance academies for children, and entrepreneurship workshops for young members of the community. Curimining has also conducted studies on the air, water, and soil properties in the zone and has established a water-management project.

Curipamba is part of the public-private partnership program that the Ecuadorian government launched in November 2021 to attract foreign investment. The project will kickstart with El Domo, a deposit of gold, silver, copper, lead, and zinc.

The mine construction will begin in Q3 2022, and production is expected to start in 2024.

What Are the Features of El Domo?

El Domo is a volcanogenic massive sulfide (VMS) deposit approximately 800 by 400 meters in size. Mineralization begins at 30 meters from the surface. Over 60,000 meters of diamond drilling were completed on El Domo.

In October 2021, Adventus Mining and Salazar Resources released El Domo’s feasibility research. The $12 million study examines the first 10 years of open-pit mining.

It includes a preliminary economic valuation for 10–14 years of underground mining as an option. The complete feasibility research on underground mining will cost $8 million more.

The feasibility study revealed that the open pit has an estimated mineral capacity of 6.5 million tonnes at 1.93 percent Cu, 2.49 percent Zn, 2.52 g/t Au, 45.7 g/t Ag, 0.25 percent Pb. It also claims that 77 percent of the life-of-mine revenues will come from payable copper and gold.

Fredy Salazar, executive president at Salazar Resources, told business-intelligence digital outlet BNamericas, that the sole pending procedure is the approval of the environmental-impact study.

If the Environment Ministry approves it and grants Curimining the environmental license by Q3 2022, it can then start building the mine immediately. In the meantime, the project managers will work through mid-2022 on the roads to access the mine.

Who Is Developing the Curipamba Project?

Curimining S.A. leads the Curipamba mining project. It is an Ecuadorian company constituted by Adventus Mining and Salazar Resources to manage the Curipamba mine development.

Adventus Mining is a Canadian mining firm devoted to exploration and development in Ecuador. It also has a portfolio of exploration projects in Ireland and non-core equity investments in several junior mining companies.

Adventus Mining is publicly listed on the Toronto Venture Stock Exchange (TSXV) under the symbol ADZN and holds partnerships with industry leaders, such as Altius Minerals, Greenstone Resources, and Wheaton. In Ecuador, Adventus Mining has allied with Nobis Group, one of the country’s largest conglomerates.

Salazar Resources is another Canada-based company listed on the TSXV under the symbol SRL. It is also working on three exploration projects in Ecuador: Los Osas, Macará, and Rumiñahui.

In addition to Curipamba, Adventus Mining and Salazar Resources have partnered on two greenfield projects, Pijili and Santiago. Both companies commit to international standards and perform responsible mining. They stress community development and environmental care.

In Curipamba, Adventus holds 75 percent ownership with a preferential 95 percent payback of future cash flows until full investment recovery. Salazar Resources owns 25 percent.

What Is the Agreement to Finance Mine Construction?

For the gold and silver anticipated sale, Wheaton will provide $180.5 million and Trafigura $45 million. In advance, Wheaton will contribute $170.5 million for the mine construction.

However, it will first transfer $13 million for previous activities and $500,000 for community-development projects. Wheaton will deposit the rest of the money in four installments during the construction after verifying the compliance of usual conditions.

The agreement with Trafigura is different since it will run through a $45 million credit line. Before the construction, it will grant $5 million, and the rest will be available in two payments during the construction after meeting the agreed terms.

Wheaton and Trafigura are willing to contribute to Adventus Mining another $5 million and $10 million, respectively, in capital investment. In this regard, Wheaton can get up to 10 percent of ownership rights on the Adventus Mining portion of the project, and Trafigura can get future rights on life-of-mine production.